The new year is often a time for reflection and goal-setting, and your finances deserve attention, too. While many people resolve to eat better, exercise more, or declutter, taking a few intentional steps with your investments can set you up for lasting financial success.

1. Revisit Your Investment Goals

Life changes fast — new family priorities, career shifts, or major purchases can alter your financial roadmap. Take time this January to review your goals. Are you saving for retirement, planning for a child’s education, or building a safety net for unexpected expenses? Ensuring your investments align with your current objectives is key to staying on track.

2. Assess Your Risk Tolerance

Market swings are inevitable, but your personal comfort with risk shouldn’t be overlooked. Consider whether your current portfolio matches your risk tolerance and timeline. A slight adjustment now can help you avoid unnecessary stress later.

3. Automate & Simplify

One of the easiest ways to stay consistent with investing is automation. Setting up regular contributions to retirement accounts, 529 plans, or other investment accounts helps your money grow steadily without requiring constant attention. Automation also enables you to capitalize on market opportunities over time.

4. Diversify and Balance

Reviewing your asset allocation is another resolution worth keeping. A diversified portfolio — spanning stocks, bonds, and other investments — can help reduce risk and improve long-term outcomes. Check that your holdings reflect a mix that works for your goals and timeline.

5. Educate Yourself Continuously

Investing can feel complex, but staying informed empowers smarter decisions. Whether it’s understanding market trends, tax strategies, or new investment tools, dedicating time to financial education pays off. Consider attending workshops, webinars, or scheduling a consultation with a financial advisor.

6. Take Advantage of Professional Guidance

Wealth advisors can help you clarify goals, create a long-term plan, and navigate market changes with confidence. Starting the year with a professional perspective may help you identify opportunities or gaps you might otherwise miss.

Your financial resolutions don’t have to be complicated — small, intentional steps can have a big impact over time.

Ready to take the next step? Schedule a consultation with our Investment Services team to review your portfolio, set goals, and start the year with a strategy built around you.

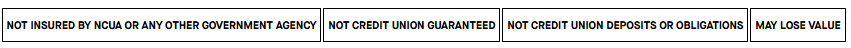

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First Commonwealth Federal Credit Union and First Commonwealth Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using First Commonwealth Investment Services and are employees of LPL. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, First Commonwealth Federal Credit Union or First Commonwealth Investment Services. Securities and insurance offered through LPL or its affiliates are:

Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

6126 Hamilton Blvd., Suite 100 | Allentown, PA 18106

LPL Financial Form CRS