As the year winds down, many people shift their focus to holiday plans and resolutions—but it’s also one of the best times to take a closer look at your financial picture. Year-end planning with a Wealth Advisor isn’t just about reviewing investments—it’s about making sure every piece of your financial life is aligned, optimized, and working toward your goals.

Why Year-End Planning Matters

The end of the year presents a unique opportunity to evaluate the effectiveness of your financial strategies and make informed adjustments before the calendar resets. From taxes to investments to retirement contributions, small changes now can have a significant impact later.

A year-end review can help you:

- Maximize tax efficiencies. Ensure you’re taking advantage of available deductions, credits, and tax-loss harvesting opportunities before December 31.

- Review investment performance. Discuss with your advisor how market trends and your portfolio’s results align with your long-term goals.

- Revisit life changes. Marriage, home purchases, new jobs, or growing families can shift your financial priorities—your plan should evolve with you.

- Refresh retirement strategies. Confirm you’re on track with contributions, allocations, and your timeline for the future you’re building.

- Set next year’s goals. Establish a clear direction for your savings, investment, or legacy plans in the year ahead.

How a Wealth Advisor Can Help

Even the most organized investors benefit from a second set of eyes. A Wealth Advisor can help you see the bigger picture, connecting your financial goals with tax planning, estate considerations, and investment strategies—all while staying aligned with your comfort level and timeline.

At First Commonwealth Investment Services, our Wealth Advisors take a personalized approach. They’ll listen, understand your priorities, and help create a customized plan that grows and adapts with you. Whether you’re optimizing your portfolio, preparing for retirement, or planning your family’s financial future, you don’t have to do it alone.

End the Year with Confidence

Before you turn the page to a new year, take a moment to ensure your finances are on the right track. Thoughtful year-end planning today can make all the difference tomorrow.

Schedule a year-end review with a First Commonwealth Wealth Advisor and start the new year with clarity, confidence, and peace of mind.

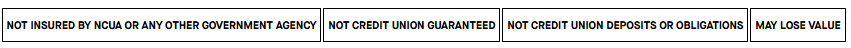

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. First Commonwealth Federal Credit Union and First Commonwealth Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using First Commonwealth Investment Services and are employees of LPL. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, First Commonwealth Federal Credit Union or First Commonwealth Investment Services. Securities and insurance offered through LPL or its affiliates are:

Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

6126 Hamilton Blvd., Suite 100 | Allentown, PA 18106

LPL Financial Form CRS