Overview

Digital Banking

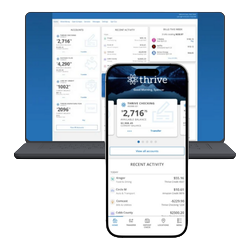

Power in Your Palm with Digital Banking

Experience the freedom of managing your finances anytime, anywhere.

Imagine having the power of a full-service financial center right in the palm of your hand. Our Digital Banking offers convenient and secure banking, so managing your account has never been easier.

- 24/7 Convenience: Access your account and view balances whenever you need, wherever you are.

- Skip the Line: Pay bills, deposit checks, transfer money, and send payments—all from the comfort of your home.

- Empowering Features: Utilize a suite of tools and insights designed to help you achieve your financial goals.

- Mobile Wallet: Seamlessly integrate with Apple Pay®, Samsung Pay®, Google Pay™, and Visa® Checkout.

- Live Support: Get online assistance from our Member Experience Associates through our chat feature.